Co-design your future

at a place like no other

Through our schools and expert faculty focused on sustainability, ethical innovation, complexity and our oceans, we empower our students to make smart decisions about the future so that — you — are able to meet the global challenges of today and tomorrow.

In the College of Global Futures, we prepare our students to address some of the greatest challenges of our time, from ensuring the social benefits of powerful new technologies and creating just and sustainable futures, to exploring solutions to emerging issues that transcend the limitations of conventional thinking.

Working with some of the world’s foremost experts at the nation’s most innovative university, your degree from the College of Global Futures will provide you with the knowledge and skills you need to thrive and make positive impacts on a future you will help to define.

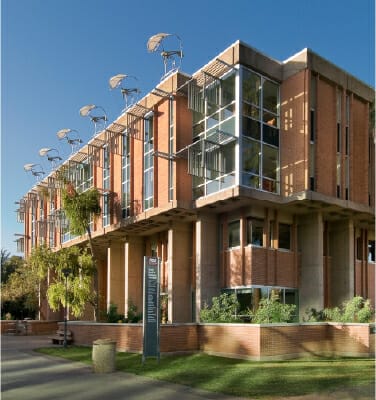

The College of Global Futures is part of the Julie Ann Wrigley Global Futures Laboratory, the world’s first comprehensive, university-based approach to ensuring a habitable planet and a future where well-being is attainable for all humankind.

Whether you are joining us virtually or at one of our physical

campuses, your opportunities for growth and success are limitless.

How do you envision your future?

Announcing the

School of Ocean Futures

With learning and research centers in Arizona, Hawaiʻi and Bermuda, the School of Ocean Futures is the world’s newest home for experiential learning and research focused on our planet’s ocean ecosystems.

The School of Ocean Futures joins three other pioneering schools in ASU’s College of Global Futures. This unprecedented institution equips students and faculty with the training and tools to develop their lifelong career pursuits while shaping a global future where all of Earth’s inhabitants and systems may thrive. Scientists and scholars in the School of Ocean Futures serve local and global communities through exploration, discovery and knowledge development at the intersection of our oceans and society. Research programs are currently underway with degrees launching Fall 2024.

Explore the College of Global Futures

Urgent issues across the globe require informed action. Our responsibility is to develop viable options that ensure well-being

for everyone. Our schools are joined by a common purpose to create new knowledge, engage diverse communities and educate

future leaders.

School for the Future of Innovation in Society

School of Sustainability

School of Complex Adaptive Systems

School of Ocean Futures

Together we can design the future

The future is not given. In uncertain times, amid great challenges, the world needs bold leaders with new ideas. Join us in the College of Global Futures at Arizona State University as, together, we work toward a more equitable, sustainable, vibrant and promise-filled future for everyone.

News

Eight reasons why our students are successful

The world’s first

Learn at the only college dedicated to a thriving planet through sustainability, innovation and complexity.

A global classroom

Explore global futures in locations around the world.

Real-time experience

Use your classroom learning as an intern in a professional environment.

Financial assistance

Find financial resources to help you attain your goals.

Great careers

Discover rewarding career resources for a life of impact.

Vibrant community

Our students, faculty and staff are dedicated agents of change.

Cutting-edge Research

Work with faculty on exciting and important projects.

World-class faculty

Our faculty is globally recognized and accessible to you.

Indigenous cultures acknowledgment

The ASU College of Global Futures recognizes that opportunities to shape the future rely on the knowledge, wisdom and practices of those who came before us.

In that spirit, we join partners across the university in acknowledging the twenty-two Native Nations that have inhabited this land for centuries, including the Akimel O’odham (Pima) and Piipaash (Maricopa) Indian Communities, whose care and keeping of these lands and traditions allow us to be here today.